In the diverse landscape of investments, traditional avenues like real estate, gold, and stocks have long been the stalwarts. However, a growing trend in the investment community is directing attention towards an unexpected asset: luxury watches. No longer just instruments of time or ornate accessories, these meticulously crafted pieces are increasingly being valued for their potential return on investment.

This article introduces luxury watches as a form of investment and explains whether it is worthwhile and how to go about it.

The History & Appeal of Luxury Watches

Centuries ago, as humans moved away from rudimentary sundials and hourglasses, the first mechanical timekeeping devices were born. Over time, these evolved from large clock towers in town squares to grandfather and wall clocks in houses, and eventually to pocket- and finally wristwatches.

The transformation was not just functional; it merged art and engineering. By the 19th century, elegant gold watches had become symbols of status and sophistication, adorning the wrists of aristocrats and influencers of the age.

- Brands like Patek Philippe and Rolex began to emerge, each promising not just accurate timekeeping but a statement of personal style and elegance. They are still some of the leading manufacturers of luxury watches today.

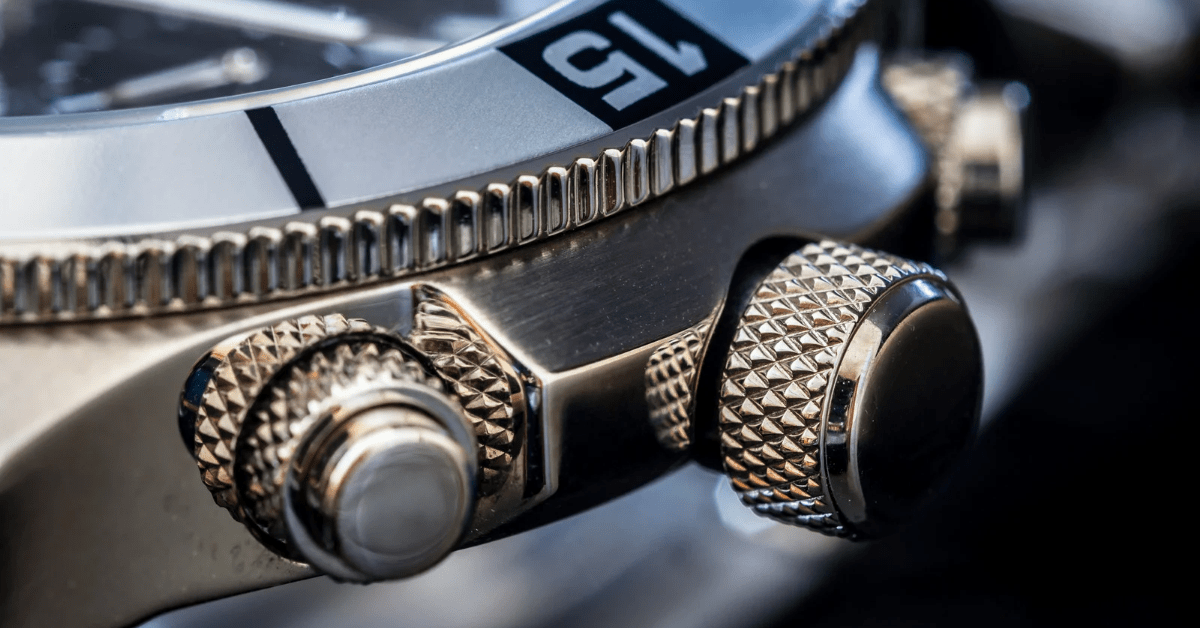

But what sets luxury watches apart from their more common counterparts? The answer lies in their craftsmanship, attention to detail, and the legacy of their brands. Each luxury watch tells a story of years of tradition, skill, and passion. Many of them are handcrafted, and therefore only exist in limited numbers.

This has led to the emergence of a popular collector’s market for luxury watches, where collectors pay large amounts of money for rare watches in good condition. The older and more intact the watch, the higher the price.

When an investor buys a coveted watch and holds on to it for a few years, they can often watch the value rise and later sell the watch for more than they originally paid.

Why are Luxury Watches Becoming Popular Investments?

Luxury watches have transcended their role as mere timepieces, carving a niche for themselves in the investment domain. But what drives this shift in perception? Here are some pivotal reasons:

Tangible Asset: Unlike intangible assets like stocks or digital currencies, luxury watches are a tactile investment. One can physically touch, wear, and admire them. This tangibility offers a sense of security and connection, knowing one’s investment isn’t just a figure on a screen.

Limited Editions & Scarcity: The world of luxury watches is rife with limited editions, special series, and commemorative pieces. This inherent scarcity drives demand. As the adage goes, rarity enhances value. With fewer pieces available, their worth often appreciates over time, making them sought-after assets.

Global Recognition: Certain brands and watch models enjoy universal acclaim. Watches from brands like Rolex, Patek Philippe, and Audemars Piguet are instantly recognizable and revered worldwide. This global recognition ensures that the investment is not just regionally limited, but has potential value across borders.

Cultural Trends: In the modern era, watches have evolved into profound status symbols. Their association with celebrity endorsements, appearances in blockbuster movies, and affiliations with significant global events have elevated their desirability. Being spotted with a luxury watch is typically equated with success, taste, and discernment.

Economic Factors: In unpredictable economic climates, traditional investments can be volatile. Luxury watches, especially those from renowned brands, have shown resilience during economic downturns. Their lasting value makes them an attractive option for diversification, especially for investors looking for stability in tumultuous times. They can be used to increase one’s financial stability or supplement the UK Pension Scheme.

In conclusion, for discerning investors, these timepieces offer an avenue that marries aesthetic pleasure with potential financial growth.

How Does Investing in Luxury Watches Work?

As an investment, luxury watches function much like paintings and other art pieces from popular artists:

- The product is oftentimes worth much more than the material and manufacturing costs. Though materials like gold and diamonds do play a role in a watch’s value and are often used in luxury watches, the finished product is typically worth much more than these resources.

- The price also includes the value tied to the artist’s fame and the prestige of owning one of their pieces. In case of luxury watches, this applies to the brand name, which entails the traditional handicraft and reputation of the manufacturer.

- Finally, current trends on the collectors’ market play a role. At any given time, there are some models that are currently more in demand than others for a variety of reasons. For example, the appearance of a famous actor wearing a specific watch can unexpectedly raise the demand for this model.

- To find a promising investment, both art and watch investors need to figure out, which artists/manufacturers and pieces are currently asked for and likely to increase over time. Therefore, it is critical to invest time in researching the past and current collectible watch market to be more likely to find popular luxury watches that are worth purchasing.

Conclusion

Navigating the realm of investments often requires a blend of knowledge, intuition, and foresight. Understanding emerging trends is essential for diversified growth. The rise of luxury watches as potential assets underscores the evolving nature of what constitutes value in the modern market. As the metrics of investment evolve, luxury watches, with their intricate balance of craftsmanship, rarity, and brand legacy, present a noteworthy avenue for portfolio expansion.

Just as with traditional investments, the key to success in the luxury watch sector lies in diligent research, comprehension of brand histories, and an awareness of market demands. For those keen on navigating this realm, an informed approach combined with a deep understanding of both historical significance and contemporary demand, is imperative.

Since the profit is not always guaranteed, it is always important to pay attention to a diverse portfolio and use the investment in luxury watches complementary with other forms of investment. It is suitable to supplement traditional investments such as shares and real estate.